|

June 2022 |

|

|

|

How to Protect the Legacy of

|

|

For generations, the children in your family have learned to swim by jumping off of the dock of your family’s vacation home. It’s a rite of passage for each grandchild to learn how to bait a hook from grandpa while fireflies flicker in the summer heat. The legacy of a vacation home is the pinnacle of the American Dream. Many people work their entire lives to afford a home in their dream destination. While you dream of passing down this home (and the memories) for generations to come, have you thought of how to protect this family legacy?

Leaving the family vacation home directly to your children may be the simplest way for transferring ownership, however, when multiple children are involved, they would all need to agree with how the property is managed and maintained in the future. These decisions are proven to be challenging not only for your children to agree on, but also their future spouses.

An LLC is often used by families, in which each family member would have a certain membership interest in the home or to give away in a controlled manner. If the home is rented at certain times of the year, the LLC can help limit the liability of the family and profits could be used to help maintain the property.

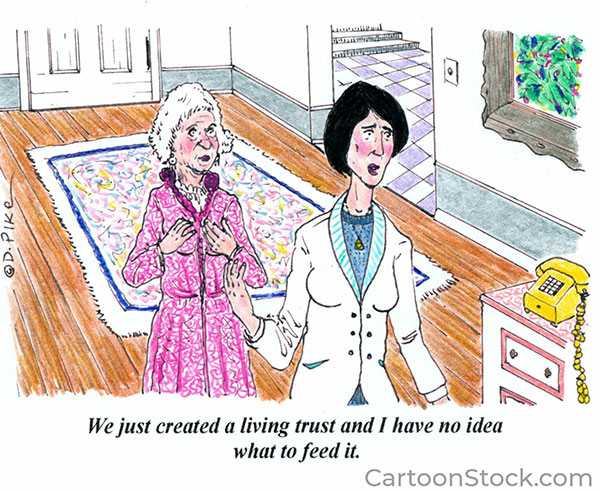

Trusts are another tool used to protect a family home. This legal agreement allows you to specify how you would like the property to be managed once you die. You can use the trust to identify who will own your vacation home, when they will have access to it, and what they will be allowed to do with the property.

One of the many benefits of placing your vacation home in a trust is to avoid probate. When you pass away, assets that legally belong to a trust will be passed on to your beneficiaries without going through probate. There are several trust options available to align with your specific needs. I few most common trusts are:

Preserving your family’s legacy of summers full of fun is important to avoid future family conflicts and avoiding litigation. Choosing the right financial structure for your family to enjoy and use the property will help guarantee family fun for future generations.

|

|

Why You Need a Digital Will |

|

|

|

Digital technology has transformed the way we live. Our society has irrevocably plunged into the digital world. As technology becomes ever more deeply embedded into our daily lives, we need to plan accordingly. “Digital Assets” is a broad term that includes a multitude of online accounts and records. A digital Will enables you to identify how you want each one of these profiles to be handled after your death. A digital Will is not the same as a traditional written Will, which is a legal document specifying how your assets will be distributed after death. You can pass some types of digital assets through your Will, but most digital assets transfer in other ways, or not at all. Online accounts and digital media have value and they could be locked or even lost if you don’t set up the appropriate protection in your Will.

Practically speaking, most of your digital assets won’t pass through your Will. However, even if you can’t pass these types of digital assets through your Will, you can (and should) make a plan for what happens to them after you are gone. In addition to notifying your loved ones of what online accounts do exist, your Will should also describe where to find them.

In most cases, your family members won’t know what you have floating in cyberspace once you die. Each website has its own requirements and legal processes for accessing accounts after death. There are a few actions you can take to make things easier to access and for your loved ones to know how you would like your digital accounts to be handled after you are gone. Between the many types of digital wallets and various online exchanges, your family will most likely be on a wild goose chase unless you make it clear where this information can be found. |

|

Some digital accounts will have a measurable monetary value, while others will have values that differ from person to person. While your cryptocurrency can be cashed out for cold hard cash, removing your online dating profile may have other complications. Below are a few digital assets and accounts to consider when documenting your digital footprint: |

|

Leaving digital assets to your loved ones after your death requires more planning than traditional and tangible assets. With a little planning, you can ensure that your beneficiaries inherit your accounts as you intended. We can help you with documenting the appropriate information and notifying your loved ones of your digital assets, along with your traditional Will. |

|

|

Don’t forget about our Young Adult Incapacity Plan and that this summer is the time to get that done BEFORE your child goes off to school: |

Upcoming Events |

|

5 Things all Kids Must Consider as their Parents AgeTuesday, July 5 5:00 PM - 6:00 PM Open Office Zoom – How To Pick Your HelpersWednesday, July 6 12:00 PM - 1:00 PM How Do I Protect My Child’s Inheritance?Monday, July 11 12:00 PM - 1:00 PM The Key Estate Planning Documents Everyone Needs and Why You May Need A Trust WorkshopEach participant will receive a copy of Tiff’s book: Tuesday, July 12 12:00 PM - 1:00 PM The Key Estate Planning Documents Everyone Needs and Why You May Need A Trust WorkshopEach participant will receive a copy of Tiff’s book: Wednesday, July 13 5:00 PM - 6:00 PM Wills & Trusts 101Wednesday, July 20 12:00 PM - 1:00 PM How to Plan for the Second Half of Life?Thursday, July 21 12:00 PM - 1:00 PM Protect Your Adult Children After Your Death With TrustsWednesday, July 27 5:00 PM - 6:00 PM Register today to reserve your spot for these events.

Additionally, registration for these events is critical so that we can contact you if it is prudent to cancel this session or if we need to change how we are able to offer this to you. |

A Personal Note From Tiffany |

|

|

We are finally into Summer! We know that life gets busy once the Fall comes around. Because of that, now is the perfect time for you to update your estate plan! Reach out to us and get scheduled for your update by 7/31 and we’ll enter you into a drawing for Apple Airpods Pro (yup, something to entice you to get it done). Think about it…You’re on a beach, looking at the water, and listening to your favorite music or podcast. Not bad, right?

If you’d like to take advantage of this, just give us a call at: 508-202-1818 or email us at: [email protected].

One final thing…if you want to increase your chances of winning that Apple Airpods Pro or something else, head over to our Facebook page this summer. We’re posting some fun things there too!

Enjoy the start of Summer!

As always, thank you for taking the time to read and reflect.

Sending you all a remote hug, |

|

|

Finally, an Estate Planning Guide for Everyone! |

|

Many books about estate planning are long, complicated, and written in a way that’s hard to understand. Not this one!

Do You Have a Plan? How to Avoid Leaving a Mess (A Guide to Estate Planning) is written by estate planning and Certified Elder Law Attorney Tiffany A. O’Connell. The book is a quick and enjoyable read, thanks in part to wonderful illustrations by Joy Murphy. The book can also be used as a reference guide to easily review important planning concepts in the future. |

|

|

|

|

3 Eliot Street | Natick, MA 01760 |