|

October 2022 |

|

|

|

A Personal Note From Tiffany:

|

|

|

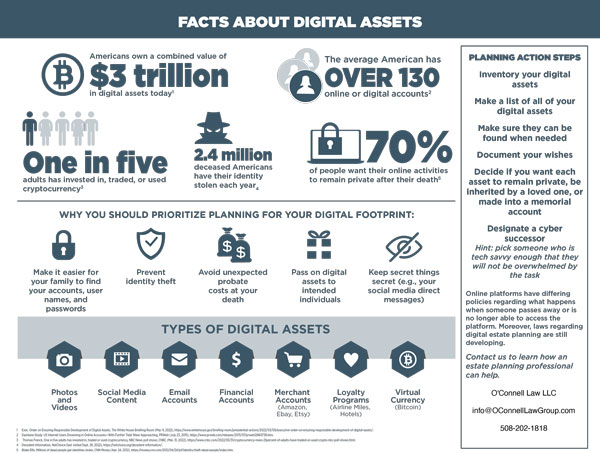

In honor of Estate Planning Awareness Week in the month of October, we’re going to be focusing on something that’s not talked about a lot, digital assets. In fact, for you visual learners, we’re providing an infographic talking about digital assets in this newsletter.

When you think about your estate plan, you probably consider your home, vehicles, family heirlooms, and financial assets. But there is another category to consider, and it is a big one—your digital assets.

The time you spend on your smartphone and computer has built a virtual warehouse of digital assets, which can include personal assets (e.g., photos, videos, gaming accounts, loyalty programs), content on your social media accounts (e.g., Facebook, TikTok), and financial assets (e.g., credit card accounts, virtual currencies, loans, retirement accounts).

Your estate plan addresses distribution of your worldly goods, but what about your digital assets? It is important to consider not only who could receive them but also who is technologically adept enough to manage and preserve them. A wide array of digital assets are a regular part of your life, so they can also have great sentimental or financial value.

Why is this important? Without a plan, your digital assets could get lost, especially if nobody knows they exist. Having a plan in place when you pass away will preserve them and avoid creating problems for your grieving loved ones. In addition, taking control of your digital assets now will maintain your privacy and help you avoid identity theft after you have passed away, which happens to millions of Americans each year.

|

|

We encourage you to watch for additional information on digital assets from us. Specifically:

|

|

We're excited about all these helpful resources that we have put together for digital assets. Please know if you need anything and you aren’t finding it with the resources we provide, just reach out to us at [email protected] or 508-202-1818.

We’re happy to help you. |

|

As always, thank you for taking the time to read and reflect.

Sending you all a remote hug, |

|

|

Make sure to follow our Facebook and LinkedIn pages this month and watch for more information and events relating to Digital Assets! |

Can You Still Retire Comfortably On A Million Dollars? |

|

|

|

Once upon a time, amassing a million dollars for retirement meant that your golden years would be very golden indeed. But what about now—is a million dollars still enough money to enjoy a luxurious retirement?

The good news is that more than 20 million people in the United States have over a million dollars. The bad news is that depending on your lifestyle, and how you want to live in retirement, one million may not be enough. Today, the opportunities for what once might have been considered a retirement on par with the “lifestyles of the rich and famous” could require closer to one million dollars, perhaps more.

Why? One reason is that in today’s economic climate, a million dollars translates into a sustainable annual income of $30,000-$40,000. That’s down from over a decade ago, where a million dollars could generate approximately $70,000-$80,000 in sustainable annual income.

While a sustainable annual income of $30,000-$40,000 is nothing to sneer at, a successful retirement depends on proper management and prudent decisions. One of the classic mistakes is to make a major purchase upon retirement, such as a boat or membership in a private golf club.

The consensus among investment professionals is that a million dollars can still provide you with a comfortable retirement, but proper planning, realistic expectations, and a sustainable cash flow are the keys to success.

One realistic expectation to set when saving for retirement is the expense that comes with funding long-term care costs. Americans are living longer than ever before. And while this is great news, it comes with a downside. For example, the median annual cost of a private room in a nursing home has hit six figures in the U.S. at $111,000 in 2022, and the cost of nursing home care and other types of long-term care are expected to rise dramatically in the future. Sadly, many families exhaust their life savings within a year or two of a family member entering a nursing home. Meaning your one or two million dollar nest egg could disappear in the blink of an eye. Fortunately, we can help you obtain the care you need without losing the assets you have worked a lifetime to build.

One way to ensure you and your family are protected for the future is to start pre-planning now. Together, we can use a wide range of tools to help you create a plan that will give you the peace of mind by knowing you will be able to receive the care you need in the future, without losing your life savings. |

Upcoming Events |

|

How to Pick Your HelpersOngoing The Key Estate Planning Documents Everyone Needs and Why You May Need a TrustOngoing 5 Things all Kids Must Consider as their Parents AgeTuesday, November 1 5:00 PM - 6:00 PM Wills & Trusts 101Wednesday, November 2 5:00 PM - 6:00 PM Wills & Trusts 101Wednesday, November 16 5:00 PM - 6:00 PM How to Plan for The Second ½ of LifeThursday, November 17 12:00 PM - 1:00 PM Generational Wealth & Protecting Your Childs InheritanceWednesday, November 30 5:00 PM - 6:00 PM Lunch & Learn With Jeff WeinerWednesday, November 30 12:00 PM - 1:00 PM Register today to reserve your spot for these webinars.

Additionally, registration for these events is critical so that we can contact you if it is prudent to cancel this session or if we need to change how we are able to offer this to you.

|

Finally, an Estate Planning Guide for Everyone! |

|

Many books about estate planning are long, complicated, and written in a way that’s hard to understand. Not this one!

Do You Have a Plan? How to Avoid Leaving a Mess (A Guide to Estate Planning) is written by estate planning and Certified Elder Law Attorney Tiffany A. O’Connell. The book is a quick and enjoyable read, thanks in part to wonderful illustrations by Joy Murphy. The book can also be used as a reference guide to easily review important planning concepts in the future. |

|

|

|

|

3 Eliot Street | Natick, MA 01760 |